Will bitcoin ever become a mainstream payment system?

This is a question I've been struggling with recently. I don’t think anyone is disputing this, but Bitcoin has changed the world. Since the Bitcoin Whitepaper was written and released by Satoshi Nakamoto 16 years ago, the digital asset's impact on the world has been stunning. This asset has radically changed how the finance industry is viewed. It has given access to users who previously found it difficult to access the world's financial system. People can now sidestep the middleman and conduct transactions with their peers without going through traditional banking bureaucracies. But has it gotten to the level where it is the preferred digital asset payment system of choice?

Walk with me.

According to research by Crypto.com at the end of 2023, it was estimated that the number of users who owned Bitcoin (BTC) had increased by 33%

Bitcoin is like a revolutionary fruit tree, brimming with brilliant potential. This tree has created branches equally adept at changing the world, but the tree is limited by the soil it is planted in. This limiting soil is scalability—the recurring problem the Bitcoin network has faced since its inception. In the spirit of the blockchain and the ideal of innovation, there have been several solutions in recent times tackling this scalability problem.

At the forefront of this is Rootstock, the first, biggest, and longest-lasting Bitcoin sidechain. The platform is nurturing a "fertile ground" for the Bitcoin tree to flourish. This article will discuss Sidechains in the Bitcoin network and how Rootstock might be the best in the market.

Below is an outline of what we’d cover in this piece:

- The Growing Pains of a Technological Marvel

- The Scalability Challenge: Network Congestion and Exorbitant Fees

- What is Rootstock?

- How Rootstock Works

- Benefits of Rootstock for Bitcoin Users and Developers

- Rootstock vs alternative scaling solution, Lightning Network.

- A Future With Rootstock

- Final Thoughts

The Growing Pains of a Technological Marvel

Before moving on with this section, the technological marvel here is Bitcoin. So, forward. Even though blockchain technology has become a buzzword in the tech and financial worlds, it is as real as it gets. Blockchain has impacted and changed a lot—hence the buzz. I've been writing about this technology since 2020 and it's a continuous shock every time I look back and see how far the industry has come. Blockchain technology has changed how we transact, share, and analyze data. This change has benefited business sectors like Finance, Healthcare, Retail, Entertainment, Real Estate, etc.

Fundamentally a distributed ledger system, the blockchain enables secure, transparent, immutable, and decentralized transactions. These features are the blockchain's core strengths and what gives Bitcoin its tremendous power. It is based on these principles that digital assets have been created. While Bitcoin has been a huge shift from what was previously obtainable in the finance industry, you can't help but think that there's a consistent and growing pain hindering the asset from reaching its full potential; a mainstream payment system of choice. This 'pain' is scalability.

The Scalability Challenge: Network Congestion and Exorbitant Fees

Imagine trying to drive through a crowded highway. This is how your transactions are on blockchains that suffer from network congestion. This congestion leads directly to the exorbitant fees charged by the network. Transaction fees are an essential component of any blockchain network because they help prevent spam transactions that slow down and clog the network. They also incentivize miners to validate transactions that support the network's security and keep miners profitable.

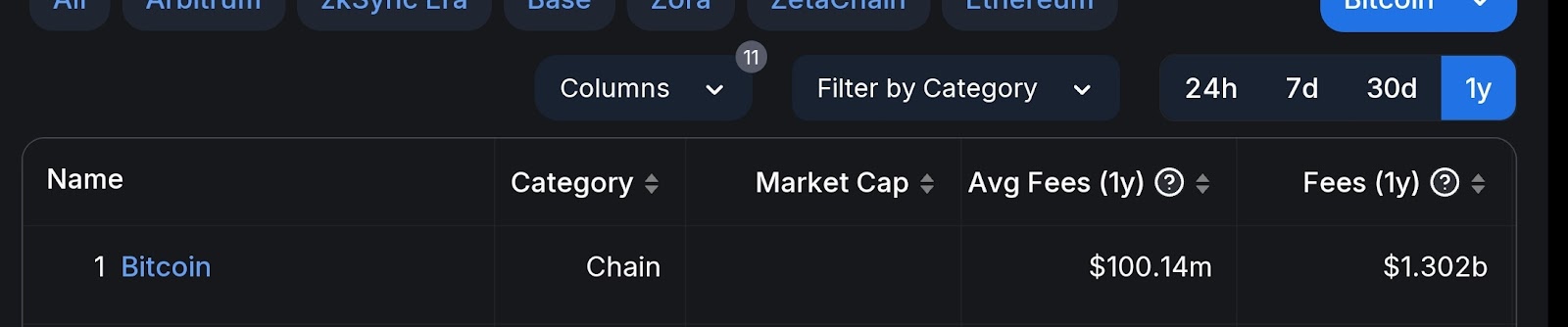

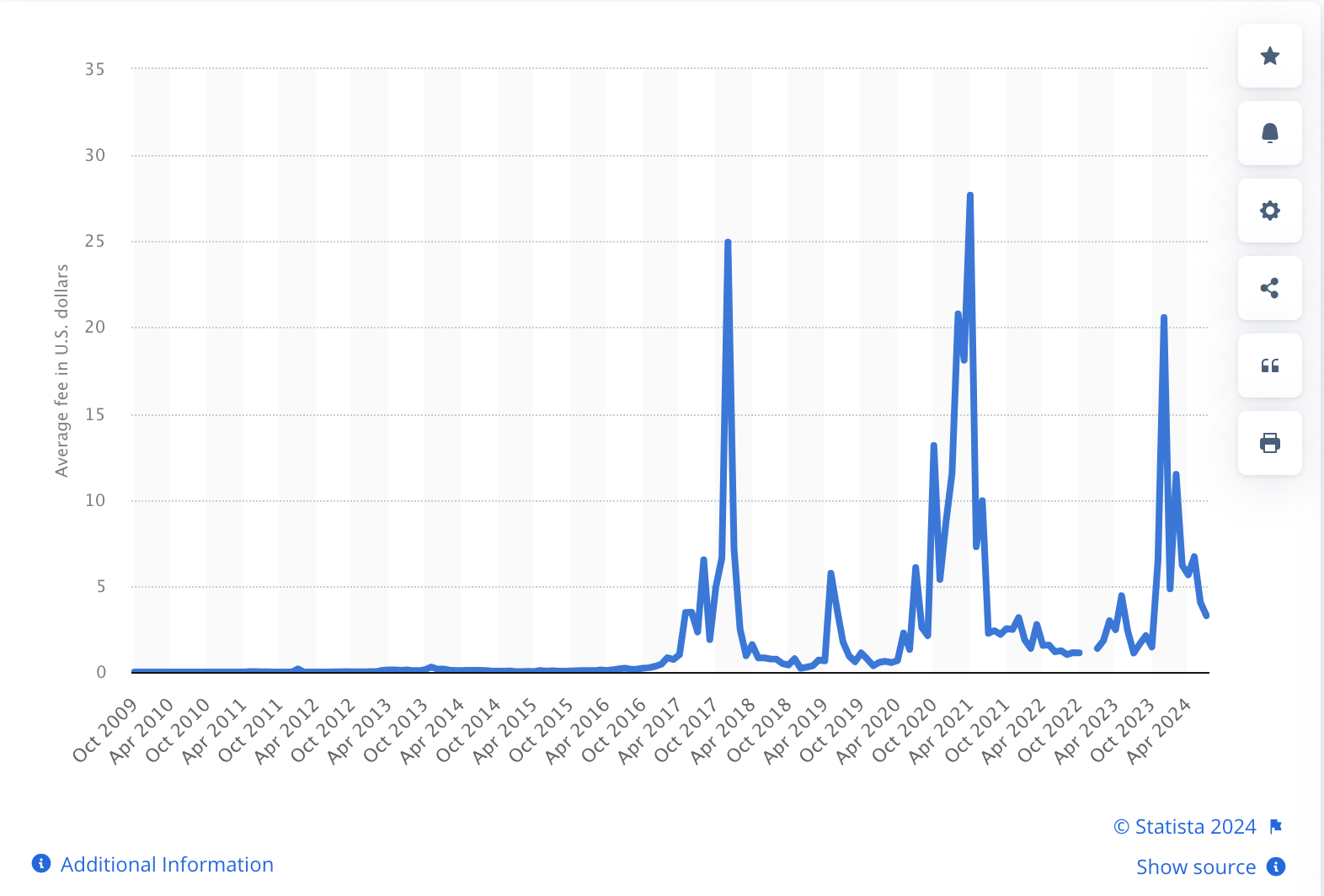

One way these fees are determined is through the demand for block space by the users. You pay more, if you want your transaction treated as a priority and confirmed faster. Transaction fees have fluctuated over time (as you'd expect from it being "highest bidder" based). We've seen fees as

The network has also experienced clogs that have prevented it from fully being the network of choice for most users. At the time of writing, the average confirmation time for a transaction on the network is

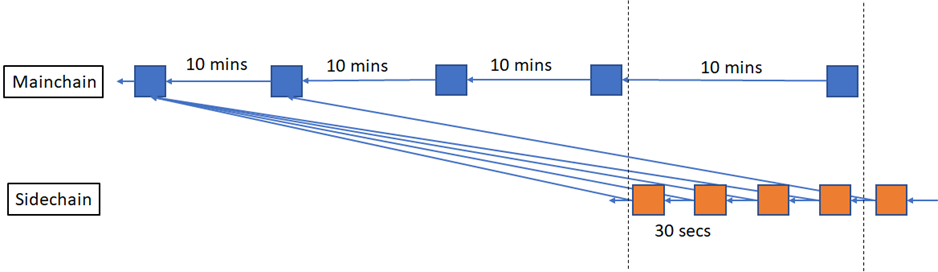

It is this combination of high transaction fees and slow processing times—the original design only allowed seven transactions per second (TPS)—that are limitations that make Bitcoin impractical for everyday use cases. This is where Sidechains and Layer-2s have been immense.

In the next section, we'll discuss one of these solutions; Rootstock.

What is Rootstock?

Rootstock (RSK) is the pioneer, biggest, and longest-lasting open-source smart contract platform powered by and connected to the Bitcoin network through a two-way peg. Since it was introduced in 2015 by developers to help increase transaction times on the Bitcoin chain and provide smart contracts, Rootstock has been at the forefront of tackling Bitcoin's scalability challenges. The solution uses its entire technology stack (from smart contracts to infrastructure framework) to add value and functionality to the Bitcoin ecosystem by enabling smart contracts, near-instant payments, and higher scalability without compromising core features like security and decentralization on the Bitcoin network.

RSK is a separate blockchain interoperable with Bitcoin (re: primary chain) designed to create a fair and inclusive financial system. This sidechain is the only Bitcoin Layer-2 that combines the security of the network's Proof-of-Work model with the capabilities of Ethereum's smart contract. RSK's sidechain allows the movement of funds in both directions (on its blockchain that exists separately from the main chain of Bitcoin, and on the main chain).

A sidechain like Rootstock fixes the scalability woes of the Bitcoin blockchain as it allows additional tasks to be completed on a secondary chain (RSK blockchain) and then be confirmed and recognized by the primary blockchain. This decreases transaction times because the primary chain can focus on mining and validating, improving the productivity and efficiency of the network. Unlike Bitcoin where it takes around 10 minutes to verify a transaction, transactions on RSK take

Some platforms that have integrated Rootstock's technologies include Symbiosis, SushiSwap, LI.FI, Jumper Exchange, Asami, Oku, etc. By merging its smart contract capabilities with these platforms, Rootstock enables the development of innovative DeFi applications like lending and borrowing platforms. Some of these platforms use the Rootstock Infrastructure Framework (RIF) token to facilitate faster and cheaper cross-border payments.

Rootstock is a product of RootstockLabs, a company that builds innovative solutions within the blockchain industry, empowering developers with funding, technology, and marketing support. RootstockLabs is dedicated to expanding the frontiers of decentralization and is on a mission to make Bitcoin work for everyone.

How Rootstock Works

Rootstock runs alongside the Bitcoin blockchain through a federated peg system—transferring assets between blockchains without needing a traditional exchange. Bitcoin (BTC) can be locked on the primary chain and represented as a smart contract-enabled bitcoin, RSK Bitcoin (RBTC) on the secondary chain. The RBTC is the native token of the Rootstock ecosystem and is pegged 1:1 to BTC. This token can be used as gas to pay for smart contract executions, just like how ETH is used as gas for Ethereum.

RBTC can be obtained by converting to and from BTC through the bridge between Bitcoin and Rootstock protocols. Less technical users can get the token from cryptocurrency exchanges.

The Rootstock system is managed by a group of entities known as the federation. Each member of this group operates a node that participates in the approval of transactions to either lock or unlock BTC. They are chosen based on security, trustworthiness, and stake in the ecosystem. No single entity has full control of the funds as it is held in a multi-signature wallet that requires a majority of the federation members to sign for funds to be released.

Benefits of Rootstock for Bitcoin Users and Developers

- Scalability: Rootstock boasts off-chain payment channels similar to the Lightning Network, which significantly increases throughput, improving transaction speed and reducing costs. At the start, Rootstock

aimed at generating blocks every 20 seconds and 300 TPS but can now scale up to 1000 TPS without sacrificing decentralization.

-

Smart Contract Functionality: RSK has a smart contract functionality that is Ethereum-like, enabling a vibrant ecosystem of decentralized applications (dApps) built on top of Bitcoin.

-

Seamless integration with Bitcoin, allows users to transfer assets between Bitcoin (BTC) and Rootstock (RBTC). This preserves Bitcoin's liquidity and user base while allowing users to leverage both worlds.

Rootstock vs alternative scaling solution, Lightning Network.

|

Feature |

Rootstock |

Lightning Network |

|---|---|---|

|

Transaction Throughput |

Is significantly faster than on-chain Bitcoin |

Potentially millions of transactions per second |

|

User Experience |

Boasts easier integration with existing wallets and tools |

Requires separate wallets and extra setup |

|

Decentralization |

Is more decentralized than the Lightning Network |

Is less decentralized because of the need for trusted intermediaries |

|

Asset Integration |

Allows seamless transfer between Bitcoin (BTC) and Rootstock (RBTC) |

Has limited asset support beyond BTC |

|

Development Stage |

Is a more mature technology already in use and has been around for over 6 years. |

Is still under development |

|

Smart Contract Support |

Supports smart contracts like Ethereum |

Has no support and is limited to basic payment functionalities |

|

Security Model |

Leverages Bitcoin’s main chain Proof-of-Work mechanism for security |

Relies on the security of participating nodes |

Future With Rootstock

If you're wondering what a Bitcoin future will look like, I'm here to tell you that the future has already taken root, flourishing, and blossoming. With its sidechain solution, Rootstock is already affecting the Bitcoin network, scaling its functionalities and making its use seamless. The platform is at the forefront of the Bitcoin network revolution, building the infrastructure for a robust and scalable Bitcoin ecosystem. The RSK Virtual Machine (RSKVM) is compatible with the Ethereum Virtual Machine (EVM), which allows for a wider developer user base. Apart from this, the RSKVM also expands on the EVM with its additional features. By allowing users to create smart contracts, develop dApps, and move assets across blockchains, Rootstock drives Bitcoin toward mass adoption and serious mainstream financial integration.

Also with a market capitalization of

Final Thoughts

Sidechains like Rootstock have the potential and ability to unlock Bitcoin's full potential. This is undeniable. The enabling of faster transactions at cheaper fees, ease of creating and launching smart contracts, and a thriving DeFi ecosystem are some pointers to the immense value that RSK provides. All of these not only benefit Bitcoin users and developers but also strengthen the entire blockchain industry.

Rootstock continues to develop solutions to address Bitcoin's scalability challenges and to understand better what they do, you can explore their resources (visit their website