This paper is available on arxiv under CC 4.0 license.

Authors:

(1) Edson Pindza, Tshwane University of Technology; Department of Mathematics and Statistics; 175 Nelson Mandela Drive OR Private Bag X680 and Pretoria 0001; South Africa [edsonpindza@gmail.com];

(2) Jules Clement Mba, University of Johannesburg; School of Economics, College of Business and Economics and P. O. Box 524, Auckland Park 2006; South Africa [jmba@uj.ac.za];

(3) Sutene Mwambi, University of Johannesburg; School of Economics, College of Business and Economics and P. O. Box 524, Auckland Park 2006; South Africa [sutenem@uj.ac.za];

(4) Nneka Umeorah, Cardiff University; School of Mathematics; Cardiff CF24 4AG; United Kingdom [umeorahn@cardiff.ac.uk].

Table of Links

- Abstract and Introduction

- Methodology

- Neural Network Methodology

- Numerical results, implementation and discussion

- Conclusion, Acknowledgments, and Funding

- Availability of data, code and materials, Contributions and Declarations

- References

2. Methodology

Jump-diffusion models are continuous-time stochastic processes introduced in quantitative finance by Merton [34], extending the work on option pricing by Black and Scholes [3]. These models reproduce stylized facts observed in asset price dynamics, such as mean-reversion and jumps. There are two ways to expound the description of jump processes.

1. One is to describe the jump in absolute terms (this is useful if we are focusing on prices or interest rates),

2. The other is to describe the jump in proportional terms (this is more useful if our focus is on returns, as in this study).

In addition to jump-diffusion models, Levy processes appear as an alternative for capturing large deviations in asset prices. Levy processes allow sample paths with frequent discontinuities, enabling them to generate heavy-tailed distributions. Some key examples include variance gamma processes, normal inverse Gaussian processes, and generalized hyperbolic processes. [51] demonstrated that Bitcoin returns exhibit heavy tails and proposed using a variance gamma process to model the price dynamics. [25] found evidence that variance gamma processes fit cryptocurrency log returns compared to classical diffusion. Levy processes have also been employed to model stochastic volatility in Bitcoin prices [5]. Overall, Levy processes provide an alternative class of models with more flexibility to account for extreme deviations. They have shown promise in fitting the empirical distributional properties of cryptocurrency returns. As this work focuses initially on extending jump-diffusion models, exploring Levy processes represents a worthwhile direction for future research. However, their ability to capture heavy tails and discontinuities suggests that Levy processes could serve as a valuable modelling technique in this domain.

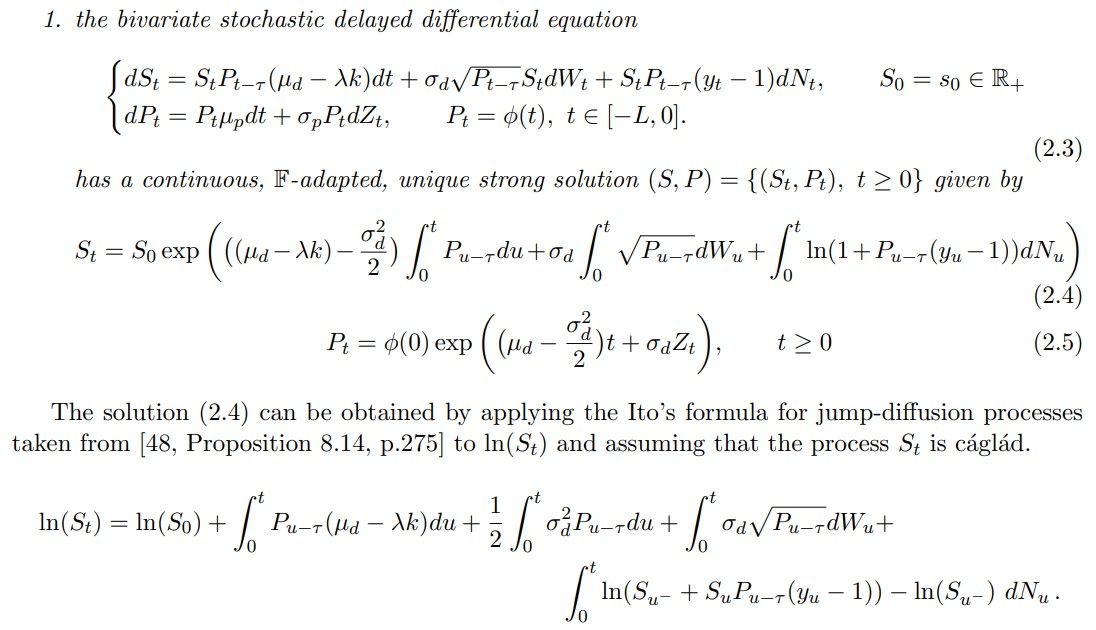

Theorem 2.1. In the market model described previously, the following holds:

2.1. Strengths and limitations of the proposed model

The bivariate jump-diffusion model provides an essential first step in applying financial engineering techniques to this new domain. By capturing stochastic volatility, discrete jumps, and a sentiment indicator, it incorporates several salient features of cryptocurrencies. The preliminary pricing and derivatives valuation framework can be built upon as the market evolves. While the assumptions require validation as more data emerges, the model offers valuable inputs for investment analysis at present. We acknowledge the need to refine techniques as cryptocurrency finance matures into its own field. This paper aims to provide the initial modelling foundation, which can be improved incrementally as research progresses. Future enhancements may include more flexible return distributions, multifactor models to capture additional risks, regime-switching models to reflect market phases, and calibration of the sentiment factor from various data sources.

In addition, the current proposed model offers a useful starting point, we recognize this initial framework may require modifications over time to align with market realities. As more cryptocurrency data becomes available, the distributional properties and other intricacies of these markets will become clearer. If the actual return distributions exhibit higher kurtosis than the normal distribution assumed, the model may need to be adjusted accordingly. Furthermore, if inefficiencies and arbitrage opportunities remain prevalent, the dynamics may diverge from a pure jump-diffusion process. As researchers expand their knowledge of the microstructure, behavioural components, and risks in cryptocurrency markets, our modelling approach can be enhanced. In summary, we emphasize this work represents a starting point for modelling cryptocurrencies and enabling financial applications. The proposed bivariate jump-diffusion model and sentiment indicator capture essential dynamics but may require adjustments as knowledge develops. We welcome future research to build on these initial techniques for pricing and valuation of cryptocurrency-denominated assets.

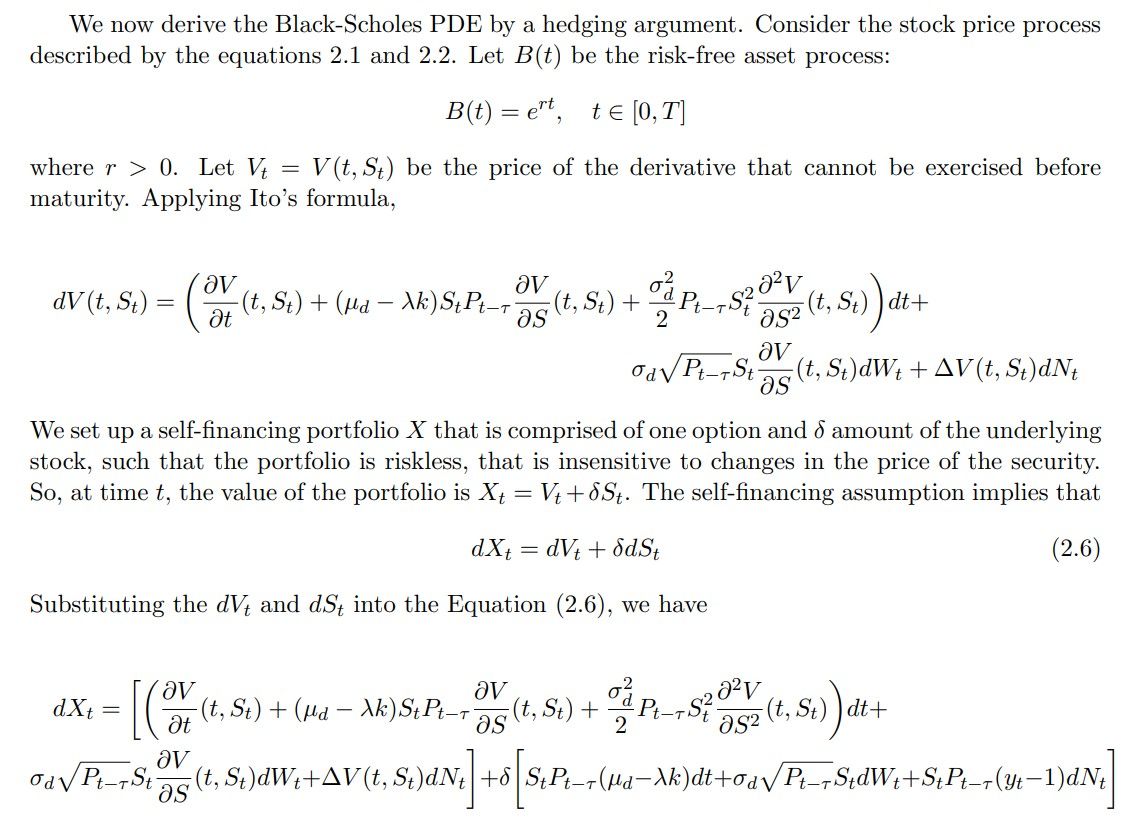

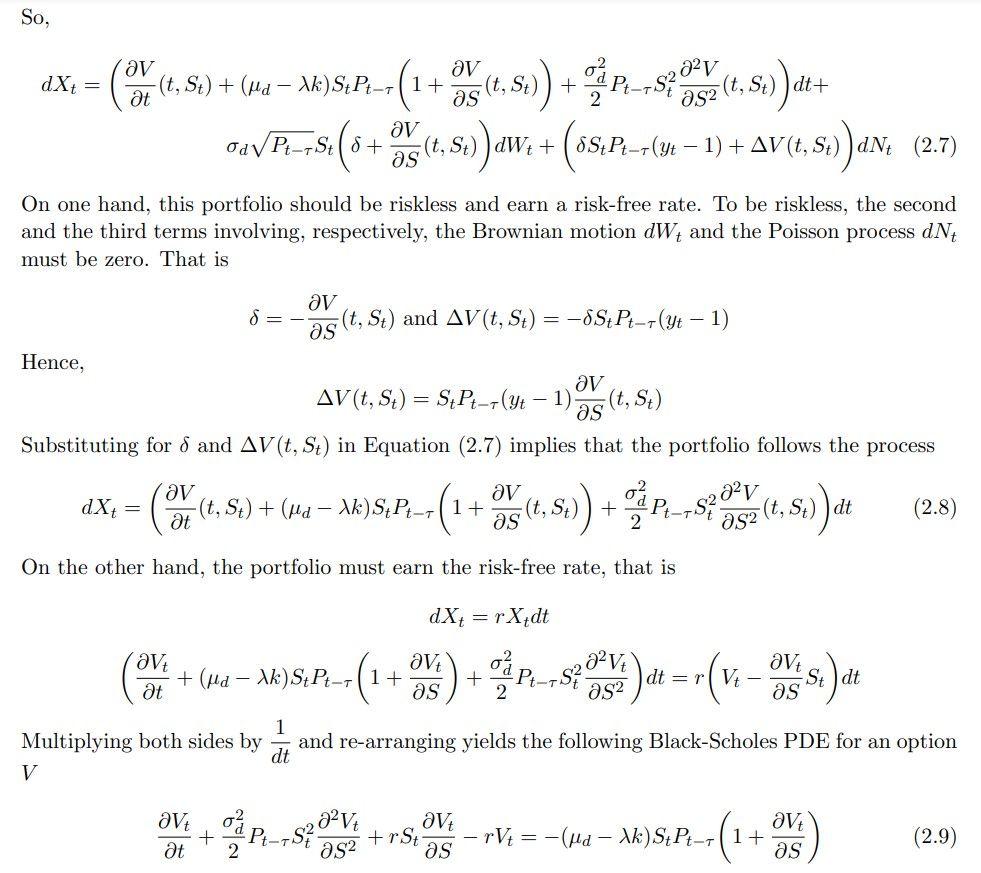

2.2. Applications

This extended Black-Scholes PDE poses challenges for analytical solutions due to the unbounded upside of the European call payoff. Therefore, numerical methods are often used to approximate the solution. Two standard techniques are finite difference methods and Monte Carlo simulation. Finite difference methods involve discretizing the price domain and time dimensions and replacing the derivatives with finite difference approximations. This transforms the PDE into a system of algebraic equations that can be solved recursively. Various finite difference schemes can be employed, such as explicit, implicit, and Crank-Nicolson. Monte Carlo simulation generates sample paths of the underlying price using the assumed stochastic process. The discounted payoffs from each sample path are averaged to estimate the option price. Variance reduction techniques like antithetic sampling and control variates can improve efficiency. Both methods have tradeoffs regarding accuracy, speed, and implementation complexity. Our proposed neural network approach serves as an alternative way to numerically solve the pricing PDE without discretizing the domain. This offers benefits in terms of generalization and scaling.